Life Insurance Policy

An important but frequently overlooked role of life insurance is the one it can play in charitable gift planning. Life insurance itself can be the direct funding medium for a gift, permitting the donor to make a substantial gift (face value of policy) for a relatively modest annual outlay (i.e., the premium payment).

How It Works

- You assign all the rights in your insurance policy to the Archdiocese, designate us as irrevocable beneficiary, and then receive an income-tax deduction

- The Archdiocese may surrender the policy for its cash value or hold it and receive the proceeds at your death

Benefits

- You receive a federal income-tax deduction

- If premiums remain to be paid, you can receive income-tax deductions for contributions to the Archdiocese to pay these premiums

- You can make a substantial gift on the installment plan

- The Archdiocese receives a gift they can use now or hold for the future

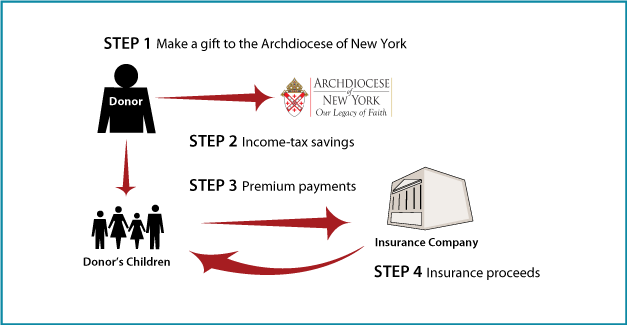

Life Insurance to Replace Gift

Life insurance can also be used to replace an asset that has been given to the Archdiocese. How it works: After a donor makes a gift to the Archdiocese, the tax savings produced by the charitable deduction are used by his or her children or an irrevocable trust to purchase and pay the premiums on a life insurance policy on the donor’s life. Such an arrangement can ensure that the interests of family beneficiaries will not be adversely affected.

How It Works

- You make a gift to the Archdiocese

- You give the tax savings from the charitable deduction to your children

- Your children purchase an insurance policy on your life with the tax savings

- Your children will receive the proceeds upon your death

Benefits

- You can make a significant gift to the Archdiocese without diminishing the amount your family will receive

- Your tax savings finance this life insurance policy

Contact Us

| Planned Giving Office 646.794.3317 [email protected] | Archdiocese of New York 1011 First Avenue 14th floor New York, NY 10022 |

© Pentera, Inc. Planned giving content. All rights reserved.