Description

This type of gift might appeal to you if you want to support the Archdiocese, are 40 to 60 years old, have a high income, need to benefit now from a current tax deduction, and are interested in augmenting potential retirement income.

The deferred-payment gift annuity involves the current transfer of cash or marketable securities in exchange for which the Archdiocese agrees to pay the donor an annuity starting at a future date—usually at the donor’s retirement. The gift can consist of a single transfer, a series of transfers, or periodic transfers to the plan in high-income years.

You realize an immediate charitable deduction for the gift portion of each transfer to establish a deferred gift annuity. A portion of each annuity payment, when the payments begin, will be a tax-free return of principal over the life expectancy of the annuitant. When appreciated long-term capital-gain securities are transferred, any reportable capital gain is spread out over the donor’s life expectancy.

Gift Range: $10,000 or more

Example: A married couple, Michael and Lisa, both 55, wish to supplement their retirement income with deferred-payment gift annuities. After consulting with their own financial advisors and a member of our staff, they decide to contribute $25,000 each year for the next ten years to the Archdiocese’s gift-annuity program.

The tax and financial benefits of this arrangement to Michael and Lisa are as follows:

- Under the deferred-gift arrangement, Michael and Lisa are entitled to a charitable deduction for each annual contribution. While the deductions vary from year to year, the total charitable deduction over the ten-year period—based on current IRS mortality and interest assumptions—will be approximately $78,229 (about 31.2% of the amount they contribute over the ten-year period).

- Beginning in the year they both attain the age of 65, when retirement income becomes important, Michael and Lisa will receive $13,775 each year from their well-planned annuities. In addition, a portion of those payments will be excludable from their taxable income for their life expectancy.

- Unlike a qualified retirement plan, there are no upper limits to their contributions or other restrictive requirements on the design of the plan.

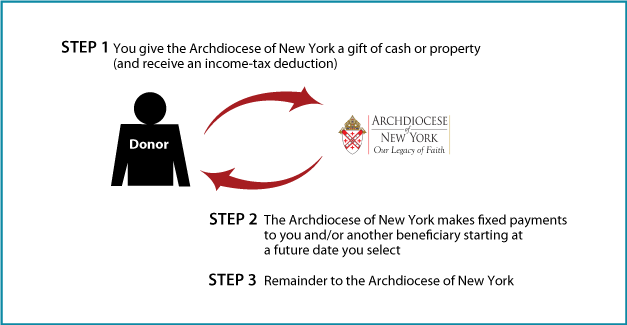

How It Works

- Transfer cash or other property to the Archdiocese

- The Archdiocese agrees to make payments for the life of one and up to two annuitants (payments are backed by our entire assets)

- The balance of the transfer inures to the Archdiocese

Benefits

- Payments for life that are favorably taxed

- When gift is funded with cash, part of payment will be tax-free

- When gift is funded with appreciated property, part will be taxed as capital gain, part will be tax-free, and part will be taxed as ordinary income

- Federal income-tax deduction for a portion of your gift

- Gift will provide generous support for the Archdiocese

More Information

- Request an eBrochure: Request an eBrochure with more information about this gift.

- Request Calculation: Receive a personal calculation of this gift.

Contact Us

| Planned Giving Office 646.794.3317 [email protected] | Archdiocese of New York 1011 First Avenue 14th floor New York, NY 10022 |