Description

The unitrust provides for annual payments of a specified percentage—at least 5% of the value of the trust as it is valued each year—to the designated beneficiary(ies). Since the value of trust assets may vary from year to year, the payments may also vary. At the death of the last income beneficiary, the trust principal is distributed to the Archdiocese of New York.

In addition to the income you will receive from the trust, you will also be entitled to a charitable income-tax deduction for the value of our remainder interest in the trust assets.

Gift Range: $100,000 or more

Example: George and Mary Carlson purchased growth stock for $20,000 ten years ago. It is now valued at $100,000, but the annual dividends are only $1,500. Now that they are both 65, they would like to augment their retirement income. To do this, they transfer the stock to a charitable remainder unitrust with a 6% payout rate.

In the first year, they will receive a $6,000 payment—four times the dividends they have been receiving—and those payments will increase in time if the assets of the unitrust appreciate in value. Moreover, they avoid tax on their profit in the stock and receive an income-tax deduction of about $27,400. In their 24% tax bracket, this saves them more than $6,575 in income taxes (24% of $27,400).

When the last beneficiary dies, the unitrust assets will benefit the Archdiocese of New York.

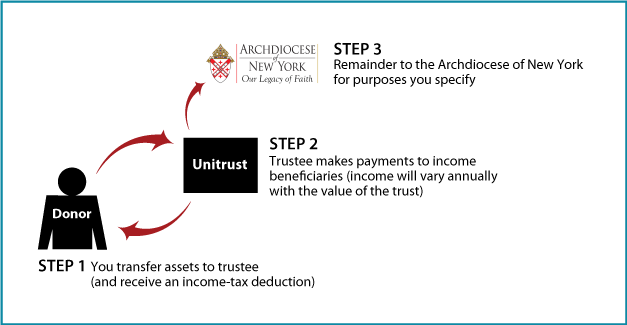

How It Works

- Create trust agreement stating terms of the trust; transfer cash or other property to trustee

- Trustee invests and manages trust assets and makes payments to income beneficiaries you designate

- Remainder to the Archdiocese of New York for purposes you specify

Benefits

- Payments to one or more beneficiaries, varying annually with the value of the trust

- Federal income-tax deduction for the charitable remainder value of your interest

- No capital-gain tax when trust is established; property is sold by the trust

- Trust remainder will provide generous support for charities of the Archdiocese of New York

More Information

- Request an eBrochure: Request an eBrochure with more information about this gift.

- Request Calculation: Receive a personal calculation of this gift.

Contact Us

| Planned Giving Office 646.794.3317 [email protected] | Archdiocese of New York 1011 First Avenue 14th floor New York, NY 10022 |

© Pentera, Inc. Planned giving content. All rights reserved.