Almost any type of real estate may be donated:

- Undeveloped land

- Farms

- Commercial buildings

- Vacation homes

- Your residence

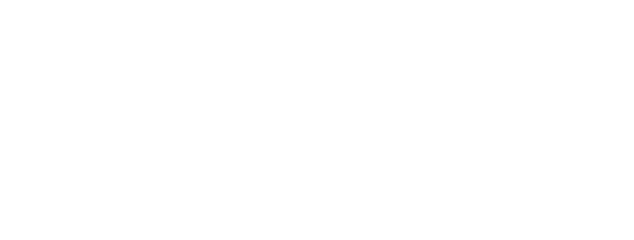

Outright Gift

How It Works

- Transfer title of property to the Archdiocese

- Receive income-tax deduction for fair-market value of property

- The Archdiocese may use or sell the property

Benefits

- Income-tax deduction for fair-market value of property based on qualified appraisal

- Avoid capital-gain tax on appreciation in value of the real estate

- Relieved of details of selling property

- Significant gift to the Archdiocese

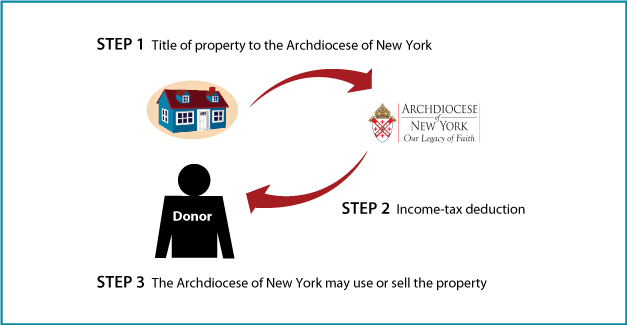

Gift of Personal Residence or Farm with Retained Life Estate

How It Works

- Transfer title to personal residence or farm to the Archdiocese

- No change in your lifestyle—you (and spouse) occupy and enjoy residence or farm for life

- The Archdiocese keeps or sells property after your death(s)

Benefits

- No out-of-pocket cost for substantial gift to the Archdiocese

- Federal income-tax deduction for remainder value of your residence or farm

- You (and spouse) can occupy residence for life

Contact Us

| Planned Giving Office 646.794.3317 [email protected] | Archdiocese of New York 1011 First Avenue 14th floor New York, NY 10022 |

© Pentera, Inc. Planned giving content. All rights reserved.