Your retirement-plan benefits are very likely a significant portion of your net worth. And because of special tax considerations, they could make an excellent choice for funding a charitable gift.

Retirement-plan benefits include assets held in individual retirement accounts (IRAs), 401(k) plans, profit-sharing plans, Keogh plans, and 403(b) plans.

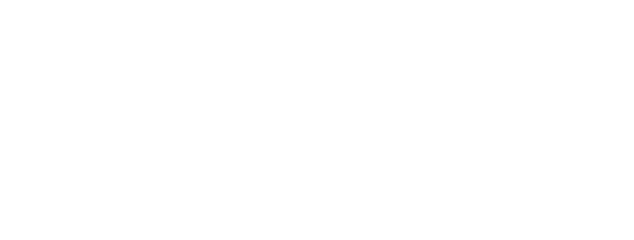

Lifetime Gifts

How It Works

- You take a distribution from your qualified retirement plan or IRA that is includable in your gross income

- You make a gift of the distribution or of other assets equal in value to the distribution

- You receive an offsetting charitable deduction

- If you are 70½ or older, read ahead about the IRA rollover opportunity available to you

Benefits

- You may draw on perhaps your largest source of assets, with no adverse tax consequences, to support the programs that are important to you at the Archdiocese

- The distribution offsets your minimum required distribution

- If you use appreciated securities instead of cash from your distribution to make your gift, you’ll avoid the capital-gain tax on the appreciation

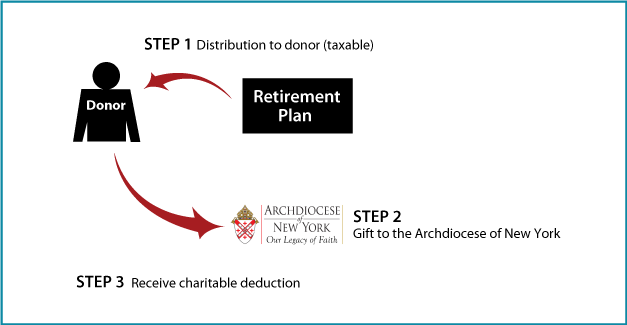

Estate Gifts

How It Works

- You name the Archdiocese as beneficiary for part or all of your retirement-plan benefits

- Funds are transferred by plan administrator at your death

Benefits

- No federal income tax is due on the funds that pass to the Archdiocese

- No federal estate tax on the funds

- You make a significant gift for the programs you support at the Archdiocese

Special note: Call or e-mail us to tell us of your intent, and we will assist you with the details of the transfer.

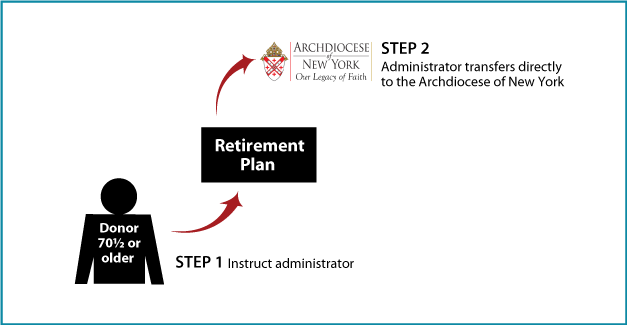

IRA Rollover Gifts: Aged 70½ or Older

How It Works

- You are 70½ or older and instruct your plan administrator to make a direct transfer of up to $100,000 to the Archdiocese

- Plan administrator makes transfer as directed to the Archdiocese

Benefits

- Your gift is transferred directly to the Archdiocese; since you do not receive the funds, they are not included in your gross income*

- Your gift will count towards your minimum distribution requirement

- You support the programs that are important to you at the Archdiocese

*No income-tax deduction is allowed for the transfer.

Contact Us

| Planned Giving Office 646.794.3317 [email protected] | Archdiocese of New York 1011 First Avenue 14th floor New York, NY 10022 |

© Pentera, Inc. Planned giving content. All rights reserved.