Do you want to support the Archdiocese of New York but worry about having enough income for yourself and your loved ones? Life-income gifts such as gift annuities and charitable remainder trusts can provide donors with an income stream, significant tax savings, and the satisfaction of providing the Archdiocese with vital long-term resources.

The creation of a life-income gift benefits both the giver and the receiver – a “win-win” situation. The following life-income gifts are available, and one may be right for you:

Immediate-Payment Gift Annuity

How It Works

- Transfer cash or other property to the Archdiocese

- The Archdiocese agrees to make payments for the life of one and up to two annuitants (payments are backed by our entire assets)

- The balance of the transfer inures to the Archdiocese

Benefits

- Payments for life that are favorably taxed

- When gift is funded with cash, part of payment will be tax-free

- When gift is funded with appreciated property, part will be taxed as capital gain, part will be tax-free, and part will be taxed as ordinary income

- Federal income-tax deduction for a portion of your gift

- Gift will provide generous support for the Archdiocese

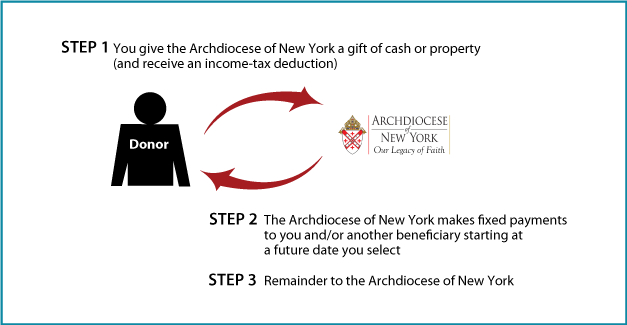

Deferred-Payment Gift Annuity

How It Works

- Transfer cash or other property to the Archdiocese

- The Archdiocese agrees to make payments for the life of one and up to two annuitants (payments are backed by our entire assets)

- The balance of the transfer inures to the Archdiocese

Benefits

- Payments for life that are favorably taxed

- When gift is funded with cash, part of payment will be tax-free

- When gift is funded with appreciated property, part will be taxed as capital gain, part will be tax-free, and part will be taxed as ordinary income

- Federal income-tax deduction for a portion of your gift

- Gift will provide generous support for the Archdiocese

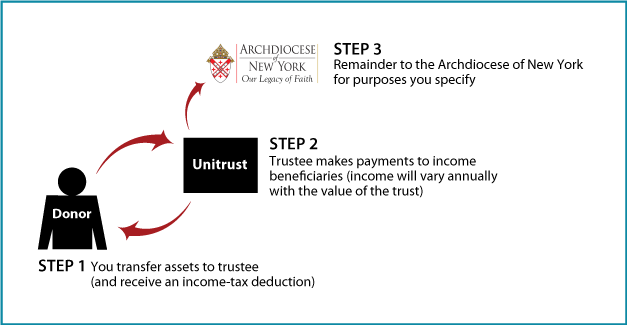

Charitable Remainder Unitrust

How It Works

- Create trust agreement stating terms of the trust; transfer cash or other property to trustee

- Trustee invests and manages trust assets and makes payments to income beneficiaries you designate

- Remainder to the Archdiocese of New York for purposes you specify

Benefits

- Payments to one or more beneficiaries, varying annually with the value of the trust

- Federal income-tax deduction for the charitable remainder value of your interest

- No capital-gain tax when trust is established; property is sold by the trust

- Trust remainder will provide generous support for charities of the Archdiocese of New York

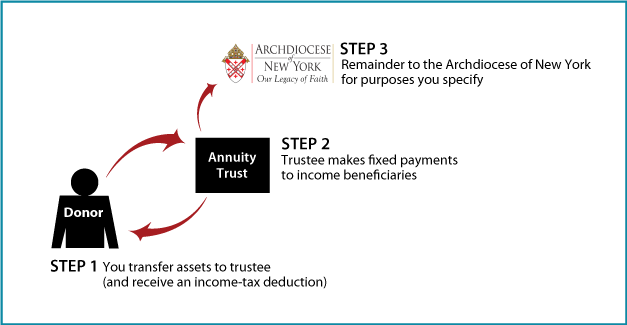

Charitable Remainder Annuity Trust

How It Works

- Create trust agreement stating terms of the trust; transfer cash or other property to trustee

- Trustee invests and manages trust assets and makes payments to income beneficiaries you designate

- Remainder to the Archdiocese for purposes you specify

Benefits

- Payments to one or more beneficiaries that remain fixed for the life of the trust

- Federal income-tax deduction for the charitable remainder value of your interest

- No capital-gain tax when trust property is sold

- Trust remainder will provide generous support for the Archdiocese

Contact Us

| Planned Giving Office 646.794.3317 [email protected] | Archdiocese of New York 1011 First Avenue 14th floor New York, NY 10022 |

© Pentera, Inc. Planned giving content. All rights reserved.